Use the table for the question(s) below.

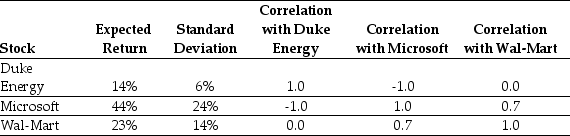

Consider the following expected returns,volatilities,and correlations:

-Consider a portfolio consisting of only Duke Energy and Microsoft.The percentage of your investment (portfolio weight) that you would place in Duke Energy stock to achieve a risk-free investment would be closest to:

Definitions:

Social Construction

A concept or practice that is created and maintained by societal norms, values, and institutions rather than by innate or inherent qualities.

Triracial Hypothesis

A sociological theory suggesting that societies tend to divide populations into three genetically distinct groups: white, black, and an intermediate group, often leading to complex social dynamics.

Socioeconomic Status

A measure of an individual's or family's economic and social position in relation to others, based on income, education, and occupation.

Triracial Stratification

A social hierarchy that divides people into three racio-ethnic groups, often privileging one over the others.

Q26: The largest stock market in the world

Q27: The _ runs a subset of the

Q32: Which of the following statements is FALSE?<br>A)If

Q37: Following the borrowing of $12 million and

Q44: Portfolio "C":<br>A)is less risky than the market

Q45: Suppose that the managers at Rearden Metal

Q46: Which of the following statements is FALSE?<br>A)As

Q54: The type of maintenance that is conducted

Q88: A computer system's _ is the quantity

Q168: The system test verifies the new system