Use the table for the question(s)below.

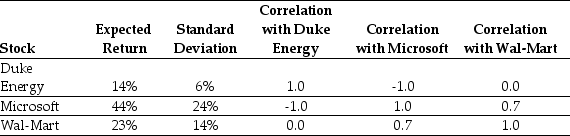

Consider the following expected returns,volatilities,and correlations:

-Consider a portfolio consisting of only Microsoft and Wal-Mart stock.Calculate the volatility of such a portfolio when the weight on Microsoft stock is 0%,25%,50%,75%,and 100%

Definitions:

Prisoners' Dilemma

A situation in game theory where two individuals acting in their own self-interest do not produce the optimal outcome for either party.

Optimal Behavior

Actions or decisions that maximize the benefit or utility to an individual or entity under given constraints.

Payoff Matrix

A table that shows the potential outcomes of different strategies in a competitive situation, typically used in game theory.

Strategic Choice

The decision-making process in the context of strategic management, where leaders select the best course of action to achieve organizational goals.

Q1: Which of the following statements is FALSE?<br>A)The

Q2: When implementing an ERP system, it is

Q6: Which of the following formulas is INCORRECT?<br>A)Variance

Q7: In 2000,the effective tax rate for debt

Q14: Which of the following organization forms accounts

Q17: Suppose that you borrow $60,000 in financing

Q30: Which of the following statements is FALSE?<br>A)The

Q35: Which of the following usually would be

Q54: Suppose that to raise the funds for

Q72: In an agency problem known as debt