Use the following information to answer the question(s) below.

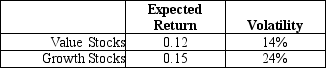

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The Sharpe ratio for the value stock portfolio is closest to:

Definitions:

Lactose Intolerance

A condition where the body lacks the enzyme needed to digest lactose, leading to digestive issues after consuming dairy products.

Rectum

The final straight segment of the large intestine, ending at the anus, where feces are stored before elimination.

Constipation

A common digestive condition where an individual experiences difficulty in bowel movements or has infrequent stools, often leading to discomfort.

Enema

A medical procedure involving the introduction of liquids into the rectum and colon via the anus, often used for cleaning or medicinal purposes.

Q2: The logical specification items might include all

Q2: MJ Enterprises has 50 million shares outstanding

Q9: Which of the following statements is FALSE?<br>A)Nonzero

Q10: The expected return on the alternative investment

Q14: Business intelligence is the integration of statistical

Q20: Using the FFC four factor model and

Q57: If Flagstaff maintains a debt to equity

Q73: Prior to any borrowing and share repurchase,the

Q103: Which of the following is unlikely to

Q129: The system development phase that precedes the