Use the following information to answer the question(s) below.

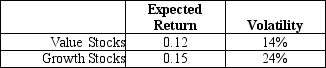

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The expected return on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Technology Shares

Stocks or equity interests in companies that operate within the technology sector.

Informational Report

A document that provides data, facts, and feedback without analysis or recommendations, intended to inform the reader.

Process

Process refers to a series of actions or steps taken to achieve a particular end.

Analytical Reports

Documents that present detailed analysis and interpretations of data or issues, often used to inform decision-making or problem-solving processes.

Q11: According to a survey of 392 CFOs

Q20: Using the FFC four factor model and

Q33: Suppose an investment is equally likely to

Q38: Performance reports are often part of a

Q41: Theoretically, in the push approach to manufacturing,

Q75: The beginning of the modern theory of

Q82: Which stock has the highest systematic risk?<br>A)Merck

Q93: The standard deviation of Little Cure's average

Q103: Which of the following statements is FALSE?<br>A)When

Q184: The user, the programmer, and another member