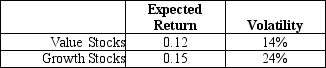

Use the following information to answer the question(s) below.

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The volatility on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Alpha Particle Emission

A type of radioactive decay in which an atomic nucleus releases an alpha particle (2 protons and 2 neutrons) and transforms into an atom with a mass number 4 units less and atomic number 2 units less.

Beta Particle Emission

A radioactive decay process where a beta particle (electron or positron) is emitted from an atomic nucleus.

Alpha Particle Emission

A type of radioactive decay in which an unstable atomic nucleus emits an alpha particle (2 protons and 2 neutrons) to form a new nucleus, decreasing its atomic number by 2 and mass number by 4.

Positron Particle Emission

A type of beta decay in which a positron is ejected from an atomic nucleus, transforming a proton into a neutron.

Q3: The expected return on the market portfolio

Q15: You are a shareholder in a "C"

Q25: Do corporate decisions that increase the value

Q36: Consider an equally weighted portfolio that contains

Q49: Suppose you invest $15,000 in Merck stock

Q63: Your firm is planning to invest in

Q74: Which of the following influences a firm's

Q81: Which of the following equations is INCORRECT?<br>A)E[R<sub>xCML</sub>]

Q98: With the _ approach to systems implementation,

Q172: The internal auditor may review acquisition projects