Use the following information to answer the question(s) below.

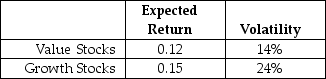

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-Which of the following is NOT an assumption used in deriving the Capital Asset Pricing Model (CAPM) ?

Definitions:

Inflammation

A biological response to injury or infection, resulting in redness, warmth, swelling, and pain in the affected area.

Tenderness

A sensation of pain or discomfort when an area of the body is touched or pressed, often indicating inflammation or an underlying condition.

Discomfort

A mild physical or emotional state of feeling unwell or uneasy.

Proctoscope

A medical instrument used to examine the inside of the rectum.

Q9: The term moral hazard refers to:<br>A)the chance

Q11: The type of maintenance that is conducted

Q14: Business intelligence is the integration of statistical

Q17: _ is the process by which assurance

Q25: Which of the following statements is FALSE?<br>A)Once

Q37: The standard deviation of the returns on

Q45: Which of the following statements is FALSE?<br>A)If

Q54: Suppose you have $10,000 in cash to

Q87: Your estimate of the asset beta for

Q107: Interviews that are conducted with personnel outside