Use the following information to answer the question(s) below.

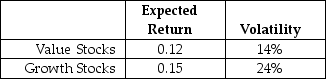

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-The Sharpe ratio for the market (which is a 50-50 combination of the value and growth portfolios) portfolio is closest to:

Definitions:

Standard

A level of quality or attainment used as a measure, norm, or model in comparative evaluations.

Modeling

A learning process where individuals emulate or adopt behaviors, attitudes, or values observed in others.

Bobo Doll Study

An experiment conducted by Albert Bandura that demonstrated how children can learn aggressive behaviors through the observation of adult models.

Demonstrates

Involves showing or proving something through evidence or argument.

Q4: The Sharpe ratio for the efficient portfolio

Q13: Which of the following statements is FALSE?<br>A)Firms

Q34: The alpha for the passive investors is

Q55: The standard deviation of the return on

Q56: Assume that you purchased General Electric Company

Q65: Which of the following statements is FALSE?<br>A)It

Q68: GAAP based financial statements are sent by:<br>A)the

Q95: Show mathematically that the stock price of

Q125: The Volatility on Stock X's returns is

Q147: Outsourcing is a term that describes an