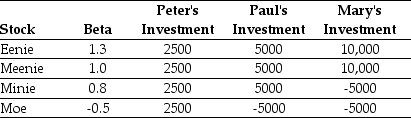

Use the table for the question(s) below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Peter's Portfolio is closest to:

Definitions:

External Factor

Influences that impact an individual or organization but originate outside of their control.

Illusion of Control

The erroneous belief that one can influence or control outcomes that are actually determined by chance.

Discounting Principle

A psychological concept suggesting that when there are multiple perceived causes for behaviour, the importance of any single cause is diminished.

False Consensus Effect

The cognitive bias where a person overestimates the extent to which their beliefs, values, or behaviors are normal and shared by others.

Q2: The logical specification items might include all

Q5: The GL/BR process is an interacting structure

Q14: Which of the following is true of

Q37: The organization's management or IT _ approves

Q61: Suppose you are a shareholder in Galt

Q65: Your estimate of the debt beta for

Q68: Which of the following investments offered the

Q78: The market capitalization of d'Anconia Copper after

Q149: A(n) _ cost is one that can

Q199: The following picture from the text illustrates