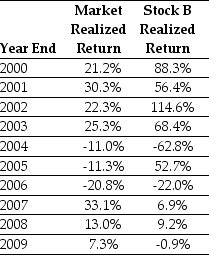

Use the table for the question(s)below.

Consider the following realized annual returns:

-Suppose that you want to use the 10 year historical average return on Stock B to forecast the expected future return on Stock B.Calculate the 95% confidence interval for your estimate of the expect return.

Definitions:

Differential Revenue

The difference in revenue between two alternative decisions or courses of action.

Course of Action

A plan or strategy that an organization or individual intends to follow to achieve a specific goal.

Alternative

An option or choice that serves as a substitute to a decision or course of action.

Intermediate Product

Goods that are produced and used as inputs in the production of other goods, rather than being sold directly to consumers.

Q2: The logical specification items might include all

Q10: The expected return on the alternative investment

Q28: Sarbanes-Oxley, Section 409 states that companies ''shall

Q59: Assuming that the risk of the tax

Q64: The NPV for this project is closest

Q74: What is the expected payoff for Little

Q94: Which of the following statements is FALSE?<br>A)There

Q98: The covariance between Stock X's and Stock

Q102: Your firm is planning to invest in

Q113: The expected return on the precious metals