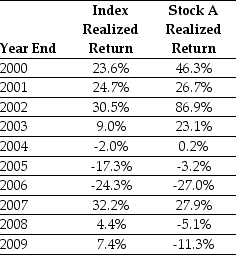

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10-year historical average return on Stock A to forecast the expected future return on Stock A.The standard error of your estimate of the expected return is closest to:

Definitions:

Q8: If Flagstaff currently maintains a debt to

Q10: Consider the following equation:<br>E + D =

Q11: Galt's WACC is closest to:<br>A)10.6%<br>B)11.2%<br>C)11.8%<br>D)12.5%

Q27: Which of the following has included management

Q61: When all investors correctly interpret and use

Q77: A bill of material contains the standard

Q89: The _ should describe operating procedures for

Q89: Suppose that Luther's beta is 0.9.If the

Q98: A cost driver is one of the

Q102: Your firm is planning to invest in