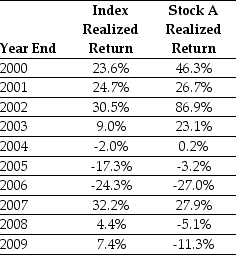

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10-year historical average return on Stock A to forecast the expected future return on Stock A.The 95% confidence interval for your estimate of the expect return is closest to:

Definitions:

Insurance

A contract represented by a policy in which an individual or entity receives financial protection against losses from an insurer.

Interconnectedness

The state of being connected with each other, often referring to systems, people, or things that are linked in such a way that they affect and depend on each other.

Social Media Revolution

The significant impact that social media has had on society, altering communication, information sharing, and business practices worldwide.

Quality Problems

Issues associated with a product or service not meeting the established standards or expectations, leading to customer dissatisfaction.

Q20: Using the FFC four factor model and

Q44: Suppose the risk-free interest rate is 4%.If

Q55: Which of the following statements is FALSE?<br>A)To

Q58: Which of the following statements is FALSE?<br>A)Beta

Q61: Suppose you are a shareholder in Galt

Q62: If the risk-free rate is 5% and

Q66: Which of the following has responsibilities and

Q95: Assume that investors in Google pay a

Q127: The direct approach is also known as

Q161: A(n) _ cost is one that is