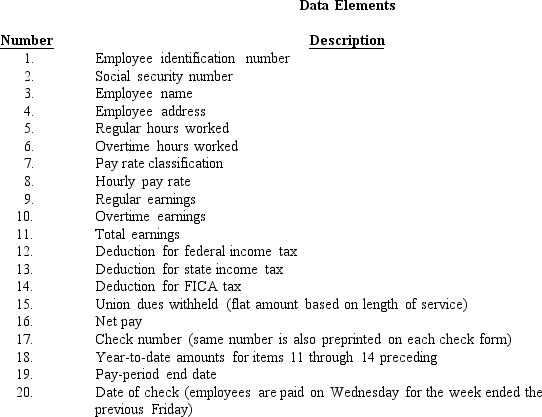

Assume you are working with a payroll application that produces weekly paychecks, including paystubs.Listed below are 20 data elements that appear on the paycheck/paystub.  Required:

Required:

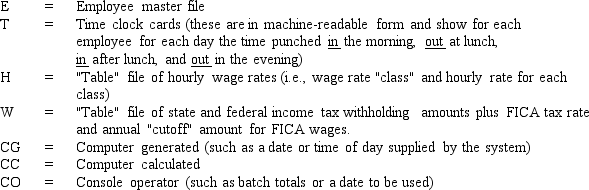

For each numbered item, indicate the immediate (versus ultimate) source of the item.For instance, the immediate source of the number of exemptions for an employee would be the employee master file as opposed to the ultimate source which is the W-4 form filed by the employee.Some items may have more than one source, as in the case of item 1.You have the following choices:

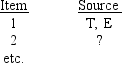

Arrange your answer as follows:

Arrange your answer as follows:

Definitions:

Federal Spending

Expenditures by the federal government on programs, services, and operations, including everything from military funding to social security benefits.

Income in Taxes

refers to the portion of individuals' or businesses' earnings that is paid to the government as tax.

Corporate Income Taxes

Taxes imposed on the income or profit of corporations by the government.

Revenue

The combined income stemming from a firm's core operations through selling products or offering services.

Q3: Which of the following represent a typical

Q18: Which of the following could be a

Q40: The final move ticket data marks the

Q48: _, when applied to cash receipts, is

Q55: The OE/S process handles the processing and

Q76: Which of the following statements regarding systems

Q78: In the control matrix of the OE/S

Q89: The following is a list of 10

Q101: A _ is designed to reflect formal

Q184: The user, the programmer, and another member