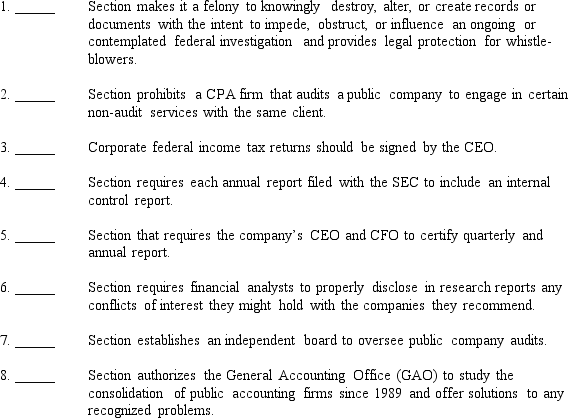

Listed below are 8 descriptions of sections of the Sarbanes-Oxley Act of 2002 (SOX) followed by the names of 8 sections of SOX.Required:

On the blank line next to the numbered section description enter a letter of the corresponding section name.Section Descriptions

Section Titles

Section Titles

a.Public Company Accounting Oversight Board

b.Auditor Independence

c.Corporate Responsibility

d.Enhanced Financial Disclosures

e.Analysts Conflicts of Interest

f.Studies and Reports

g.Corporate and Criminal Fraud Accountability

h.Corporate Tax Returns

Definitions:

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life.

Accounts Payable

Liabilities of a business that are due to creditors within a short period, typically less than a year.

Net Cash

The amount of cash available after all cash inflows and outflows have been accounted for, often within a specific reporting period.

Sale Of Equipment

The act of selling off machinery, tools, or devices used in production or office operations, often recorded as a cash inflow in financial accounts.

Q21: Which of the following data flow diagram

Q29: A control plan requires that a manager

Q32: The benefits of electronic document management include

Q49: Which of the following is not a

Q51: A collection of data representing multiple occurrences

Q55: The following symbol represents general purpose input-output.

Q60: A control plan requires that a manager

Q62: Risk assessment is best described by:<br>A)Internal and

Q135: The functions of the _ commonly include

Q136: A facility usually comprised of air-conditioned space