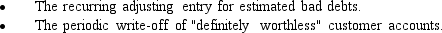

Below is the narrative of the "Manage customer accounts" portion of the B/AR/CR process.

Narrative Description

Processes 2.1 through 2.3 relate to sales returns adjustments.This process begins when there is notification from the receiving department that goods have been returned by a customer.Subprocess 2.1 obtains data from the accounts receivable master data to validate the return.If the sales return is not valid,it will be rejected (see Reject stub)and processed through a separate exception routine.If the sales return is valid,it is sent to subprocess 2.2 where a credit memo is prepared and sent to the customer,and the accounts receivable master data is updated to reflect the credit.At the same time,the validated sales return is sent to subprocess 2.3 where a journal voucher is prepared,which is used to create a record in the AR adjustments event data store (i.e. ,the journal),and the general ledger is notified that a credit memo has been issued.This results in updates to sales returns and allowances and to AR.

Process 2.4 is triggered by a periodic review of aging details obtained from the accounts receivable master data.The aging details would be used to identify and follow up on late-paying customer accounts.One of two types of adjustments might result from this review:

Like process 2.4,bubble 2.5,"Prepare customer statements," also is triggered by a periodic event that recurs at specified intervals,often on a monthly basis in practice.Details of unpaid invoices are extracted from the accounts receivable master data and are summarized in a statement of account that is mailed (or sent electronically)to customers.

Required:

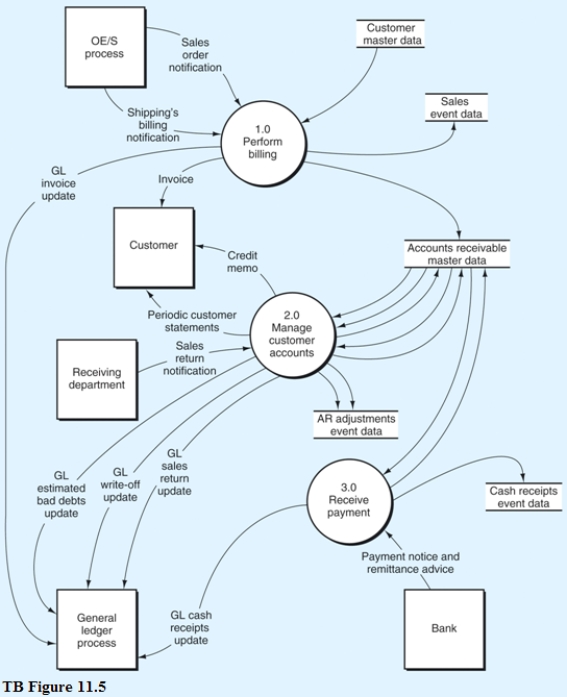

Using the DFD in TB Figure 11.5 and the narrative description above,identify the words that belong in items 1 to 15 of Diagram 2.0 (TB Figure 11.6).

Definitions:

Cash Payments

Transactions where payment is made using cash, as opposed to checks, credit cards, or electronic transfers.

Credit Sales

Transactions where the buyer is allowed to pay for goods or services at a later date, extending credit by the seller.

Cash Collections

The process of gathering and managing the cash received from sales, services, or other receivables.

Income Tax Expense

The cost to a company for income taxes owed to federal, state, and local governments, recorded as a financial expense in accounting.

Q1: Which type of supply chain collaboration methods

Q7: The warehouse number is the primary key

Q44: Digital images:<br>A) help reduce paper in the

Q56: Which of the following activities would not

Q71: A computer abuse technique called a back

Q74: Online prompting helps guide the online entry

Q94: Systems that allow employees to access their

Q100: The _ is charged with safeguarding the

Q115: _ advises customer service representatives to check

Q154: Which of the following is not one