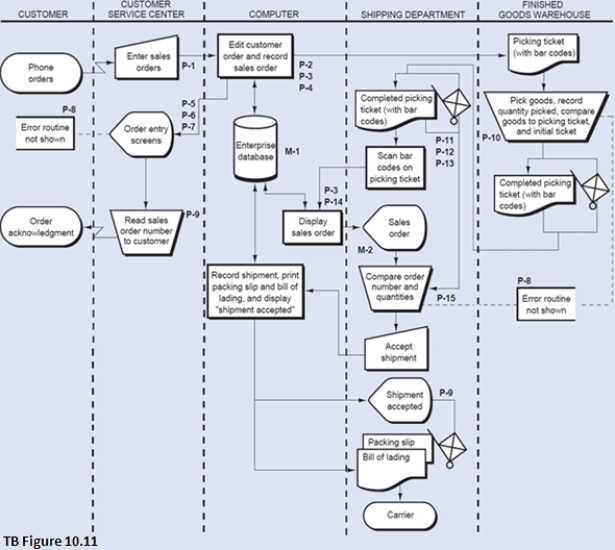

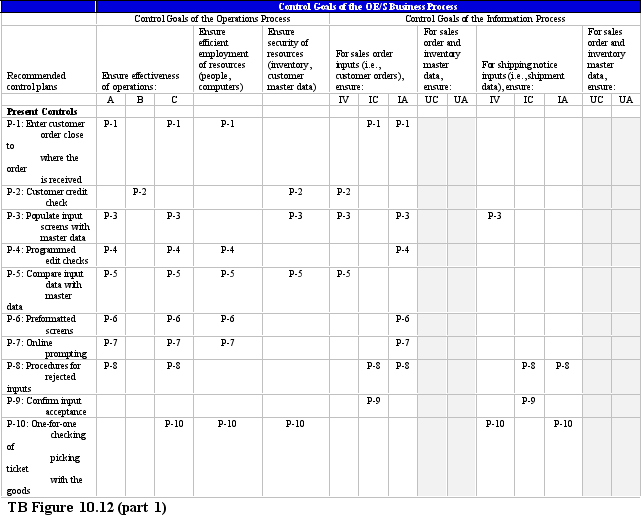

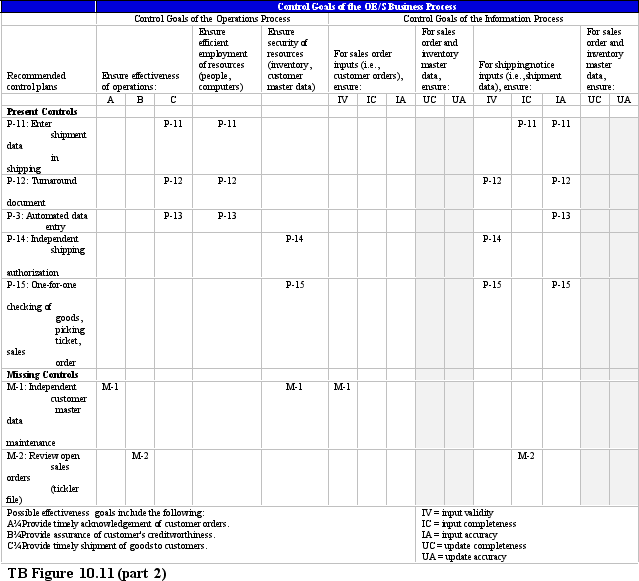

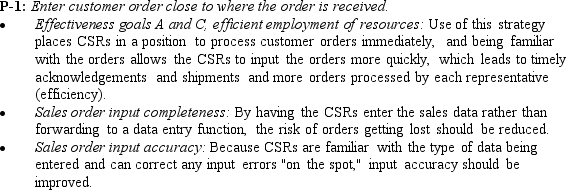

TB Figure 10.11 is the annotated systems flowchart for the order entry/sales process.TB Figure 10.12 is the related control matrix.Following the control matrix is a description of the first control plan,P-1.

Required:

Using the format shown for control plan P-1,write descriptions for control plans P-2,P-10,P-14,P-15,and M-1.

Definitions:

Temporary Difference

A difference between the carrying amount of an asset or liability in the balance sheet and its tax base, which will result in taxable or deductible amounts in the future.

Book Income

The income of a business as reported in its financial statements, using the accounting methods and standards specified by the relevant authority.

Deferred Tax Liability

A tax obligation that a company owes but is not required to pay until a future date.

Warranty Expense

Costs that a company incurs to repair, replace, or compensate for faulty products during the warranty period.

Q1: Which of the following statements is true?<br>A)

Q13: Below is a list of control goals

Q15: TB Figure 12.9 is the control matrix

Q23: Sending out an e-mail pretending to be

Q37: A control that is primarily directed at

Q52: _ is a strategy for the capture

Q64: In an entity-relationship (E-R)diagram for the OE/S

Q68: A(n)_ is a business document used to

Q74: The department or function that develops and

Q92: In a(n)_ billing system,invoices are prepared after