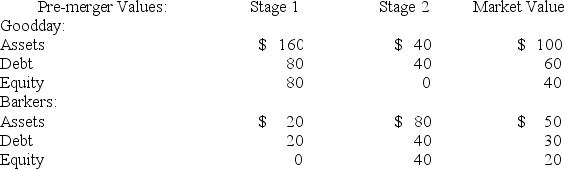

Goodday is merging with Bakers.Goodday has debt with a face value of $80 and Baker has debt with a face value of $40.Bakers' stockholders receive stock in the combined firm in an amount equal to the stand-alone market value of Bakers.The pre-merger values of the firms given two economic states with equal probabilities of occurrence are as follows:  What will be the gain or loss to the current shareholders of Goodday if the merger provides no synergy?

What will be the gain or loss to the current shareholders of Goodday if the merger provides no synergy?

Definitions:

Micro-Level Influence

Impact or effects seen at an individual or small group level, often in contrast to macro-level influences.

Individual Choices

Decisions made by a person based on personal preference, values, and circumstances, affecting their life and actions.

Technological Innovations

The introduction of new technologies or methods that significantly improve products, processes, or services, often driving economic growth and societal change.

Macro-Level Perspective

A social science perspective that focuses on large-scale patterns and processes that characterize society as a whole.

Q6: What phenomenon has been suggested as one

Q11: What is the key element of the

Q12: Outer Wear has 12,000 shares of stock

Q17: Credit scoring models are used by lenders

Q24: Why is straight NPV analysis flawed as

Q34: The relationship between the prices of the

Q35: Which one of these is not a

Q54: Money market securities are best defined as

Q69: You sold a put contract on EDF

Q80: A firm has an inventory turnover rate