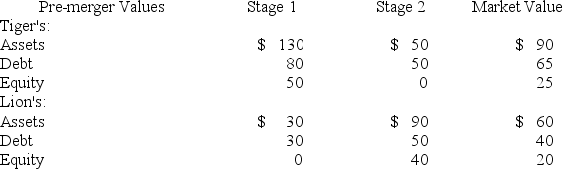

Tiger's is merging with Lion's.Tiger's has debt with a face value of $80 and Lion's has debt with a face value of $50.The pre-merger values of the firms given two economic states with equal probabilities of occurrence are as follows:  What will be the combined gain or loss to the bondholders of these two firms if the merger provides no synergy and Lion's stockholders receive stock in the combined firm in an amount equal to the stand-alone value of Lion's?

What will be the combined gain or loss to the bondholders of these two firms if the merger provides no synergy and Lion's stockholders receive stock in the combined firm in an amount equal to the stand-alone value of Lion's?

Definitions:

Q1: All of the following are true regarding

Q2: Discuss the factors that management must consider

Q8: Jeff is analyzing an expansion project for

Q15: From the bondholder's point of view,the optimum

Q28: Flow-based insolvency is defined as:<br>A)a balance sheet

Q31: Credit default swaps are most like:<br>A)inverse floaters.<br>B)call

Q36: Turner's has $3.8 million in net working

Q37: Assume a bond matures in 2 years,has

Q56: Assume a merger of two unlevered firms

Q61: Eastern Shore Merchants has 75,000 shares and