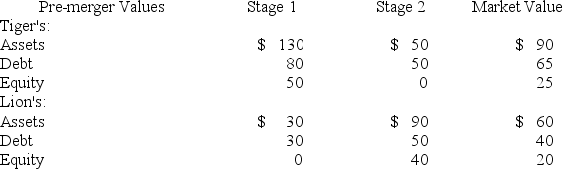

Tiger's is merging with Lion's.Tiger's has debt with a face value of $80 and Lion's has debt with a face value of $50.The pre-merger values of the firms given two economic states with equal probabilities of occurrence are as follows:  What will be the combined gain or loss to the bondholders of these two firms if the merger provides no synergy and Lion's stockholders receive stock in the combined firm in an amount equal to the stand-alone value of Lion's?

What will be the combined gain or loss to the bondholders of these two firms if the merger provides no synergy and Lion's stockholders receive stock in the combined firm in an amount equal to the stand-alone value of Lion's?

Definitions:

Control Groups

A group in an experiment that does not receive the treatment being tested and is used as a benchmark to measure how the other tested subjects do.

Motivational Interviewing

A counseling approach that helps individuals find the internal motivation to change their behavior through exploring and resolving ambivalence.

Person-centered Therapies

A form of psychotherapy focusing on the individual's experience and emphasizing the importance of being in a therapeutic condition perceived as safe and supportive by the client.

Meta-analysis

A statistical technique that combines the results of multiple scientific studies to identify patterns, strengths, and weaknesses among the findings.

Q4: Disadvantage of principles-based standards is:<br>A)They supply broad

Q17: Assume Jamestown Markets has 500 shares of

Q20: A convertible bond matures in 15 years,pays

Q20: APR,as it relates to the liquidation of

Q29: The gain on a call is computed

Q43: Assume the futures contracts on silver are

Q45: A financially solid firm is most apt

Q46: Assume a bank has a $25 million

Q73: The cash cycle is defined as the

Q81: Uptown Bank has granted a line of