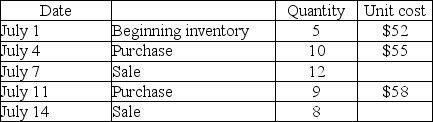

Lionworks Enterprises had the following inventory data:

Assuming FIFO,what is the ending inventory after the July 14 sale?

Definitions:

Tax Rate

The percentage at which an individual or corporation is taxed, which can vary depending on income or profits respectively.

WACC

Weighted Average Cost of Capital; the average rate of return a company is expected to pay to all its security holders to finance its assets.

Par Value

The face value of a bond or stock as stated on the certificate or instrument, which differs from its market value.

WACC Calculation

The process of calculating the Weighted Average Cost of Capital, which measures a firm's cost of capital from all sources, weighted according to the proportion of each capital component.

Q2: The LEAST widely used of the four

Q15: A company has net sales of $126,000,cost

Q17: A company has $8,200 in net sales,$1,100

Q32: The Supplies account must be adjusted to

Q33: The posting reference column of the general

Q111: When using the FIFO inventory method,the ending

Q113: Goods such as milk,bread,and cheese need to

Q115: The choice of inventory costing method does

Q134: The following is selected data for Northwest

Q156: Disposal of a plant asset always occurs