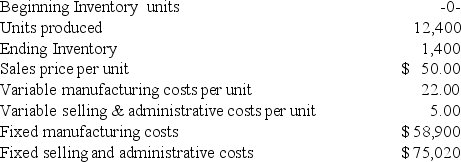

Using the given information, determine the income under both the absorption and the direct (variable)costing methods for CRL Company this year. Explain the difference, if any.

Definitions:

Current Taxes

Taxes that are due and payable within the current fiscal or tax year.

Personal Income Taxes

Taxes imposed on individuals or households by the government based on their income, where the tax rate increases as the taxable amount of income increases.

Adult Americans

Adult Americans refer to individuals within the United States who are legally recognized as adults, typically 18 years of age or older.

Tax Liability

The total amount of taxes owed by an individual, corporation, or other entity to a taxing authority such as the government.

Q3: Fraser Manufacturing had no work in process

Q34: The beginning and ending balances of the

Q39: If a decision must be made about

Q49: Which of the following is NOT a

Q63: At the end of the month, if

Q71: <br>The material usage variance was:<br>A)$6,500 favorable.<br>B)$900 unfavorable.<br>C)$900

Q72: Rounding is often necessary to make the

Q76: Which of the following is not an

Q82: Beginning and ending finished goods inventory are

Q107: Nonoperating income, such as interest income, should