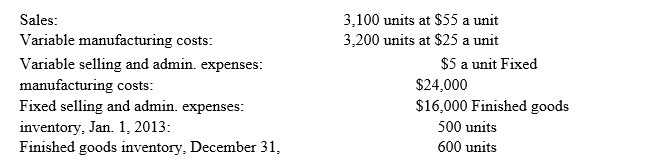

The data given below pertains to the operations of the Newton Products Corporation for the year ended December 31, 2019

Based on the information given prepare an income statement for the year using the absorption costing approach. Assume that the beginning finished goods inventory had a cost of $32.50 per unit.

Definitions:

Isocost

A line representing all combinations of production factors that have the same total cost.

Capital

Refers to financial resources or assets owned by a business or individual that are used to generate wealth through investment or production.

Slope

In mathematics and economics, it refers to the measure of the steepness or incline of a line, often representing the rate of change between variables.

Isocost

Lines representing all combinations of inputs that have the same total cost.

Q5: The information systems audit objective that pertains

Q7: Describe the two methods to manage accounts

Q12: Data must be converted into information to

Q13: Finished Goods beginning and ending balances are

Q13: When properly deployed,accounting information systems can provide

Q16: An accounting information system (AIS)processes _ to

Q33: On a worksheet for a manufacturing business,

Q36: The cost of a unit produced in

Q53: Marking transactions with a special code,recording them

Q109: Auditors often use reperformance to test a