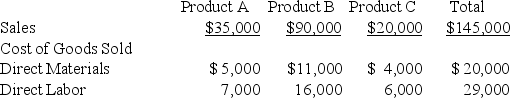

The data given below is taken from the budgeted income statement of the Arrow Corporation for 2019. It shows the projected net income or loss for each of the firm's three products. Management is concerned about the budgeted loss for Product C and wants to discontinue it. Prepare an analysis indicating the effects of discontinuing Product C. Based on the analysis, indicate the decision that should be made.

Additional information:

(a.)Materials and labor are variable costs.

(b.)Total manufacturing overhead is applied at 50 percent of the direct labor costs. (c.)Variable overhead is 10 percent of the direct labor costs.

(d.)Fixed overhead totals $11,600 a year.

(e.)Operating expenses include variable costs at 20 percent of sales dollars. (f.)Fixed operating expenses total $18,000.

(g.)Fixed overhead costs and fixed operating expenses are expected to continue if Product C is eliminated.

Definitions:

Direct Materials

Raw materials that are directly traceable to the manufacturing of a product and are an integral part of the finished product.

Units

A measurement or quantity of something, often used in the context of sales, production, or inventory in business settings.

Flexible Budget

A budget that adjusts or flexes with changes in volume or activity levels, allowing for more accurate budgeting in dynamic environments.

Budgeting Formulas

Mathematical expressions or calculations used to estimate future financial performance, resources needed, or costs associated with specific goals.

Q11: If manufacturing overhead is applied at a

Q16: <br>Using direct costing, the marginal income on

Q48: An auditor sets an embedded audit module

Q57: Kobold Company manufactures lamps. In May, Department

Q71: Using embedded audit modules to continuously monitor

Q85: Raw materials purchased during the month were

Q90: Which of the following is not one

Q95: During the month, 2,450 units of a

Q97: Reversing entries help save time and prevent

Q103: <br>The labor efficiency variance in January is:<br>A)