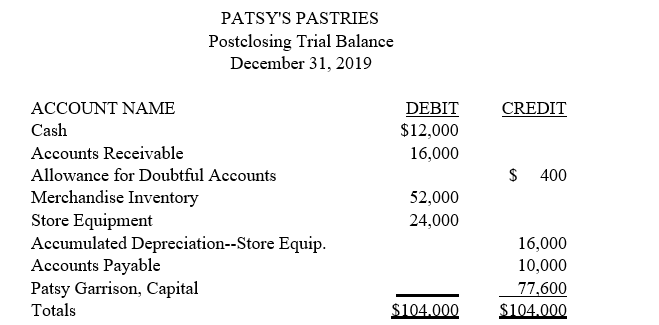

Patsy Garrison owns and operates a bakery called Patsy's Pastries. Her postclosing trial balance on December 31, 2019, is provided below. Garrison plans to enter into a partnership with Erika Noreen, effective January 1, 2020. Profits and losses will be shared equally. Garrison will transfer all assets and liabilities of her store to the partnership, after revaluation. Noreen will invest cash equal to Garrison's investment after revaluation. The agreed values are: Accounts Receivable (net), $15,000; Merchandise Inventory, $54,000; and Store Equipment, $16,000. The partnership will operate under the name Baker's Delight. Record each partner's investment on page 1 of a general journal. Omit descriptions.

Prepare a balance sheet for Baker's Delight just after the investments.

Definitions:

DSM-5

The fifth edition of the Diagnostic and Statistical Manual of Mental Disorders serves as the definitive guide for healthcare professionals in diagnosing mental health conditions.

Diagnosis

The process of determining by examination the nature and circumstances of a diseased condition or injury.

Epigenetics

The study of how the expression of genes is influenced by factors other than changes in the DNA sequence, leading to changes in phenotype without altering the genotype.

Environmental Influences

External factors surrounding an individual that impact behaviors, development, and life outcomes.

Q4: James Cavanaugh, proprietor, has agreed to take

Q6: At the end of the current year,

Q9: The holder of a share of 12

Q15: Bonds with a face value of $400,000

Q29: If the property used in a business

Q31: If the ratio of total stockholders' equity

Q81: The most conservative method of applying the

Q83: Corporations are subject to the same tax

Q90: When using the allowance method for accounting

Q97: The entry to record the appropriation of