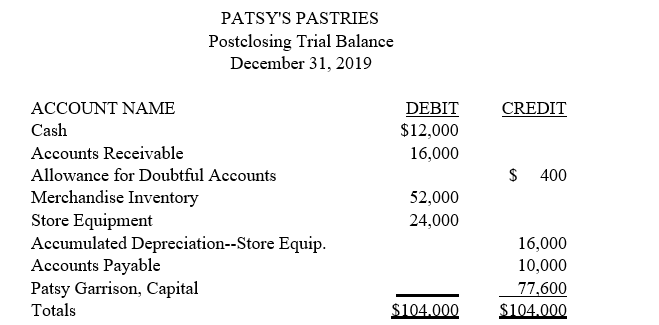

Patsy Garrison owns and operates a bakery called Patsy's Pastries. Her postclosing trial balance on December 31, 2019, is provided below. Garrison plans to enter into a partnership with Erika Noreen, effective January 1, 2020. Profits and losses will be shared equally. Garrison will transfer all assets and liabilities of her store to the partnership, after revaluation. Noreen will invest cash equal to Garrison's investment after revaluation. The agreed values are: Accounts Receivable (net), $15,000; Merchandise Inventory, $54,000; and Store Equipment, $16,000. The partnership will operate under the name Baker's Delight. Record each partner's investment on page 1 of a general journal. Omit descriptions.

Prepare a balance sheet for Baker's Delight just after the investments.

Definitions:

Socio-cultural Conditions

The social and cultural circumstances that influence an individual's life, such as norms, values, practices, and customs prevalent in their society.

Inflation

A general increase in prices and fall in the purchasing value of money over time.

Income Levels

Categories or ranges of annual income that individuals or families fall into based on their earnings.

Wheel of Innovation

A conceptual model that illustrates the continuous process of innovation, including idea generation, development, and implementation, driving organizational growth and competitiveness.

Q3: Identify and discuss the key characteristics of

Q17: On July 5, 2019, the Cowens Company

Q39: The entry to record the issuance of

Q54: Harrod's Landscape Artists acquired a new truck

Q61: Net income for the Gifts Galore for

Q68: The book value of an asset is

Q87: Which of the following statements is not

Q95: The face value of a noninterest-bearing note

Q95: Using the information given, discuss J &

Q109: When bonds are sold by a company,