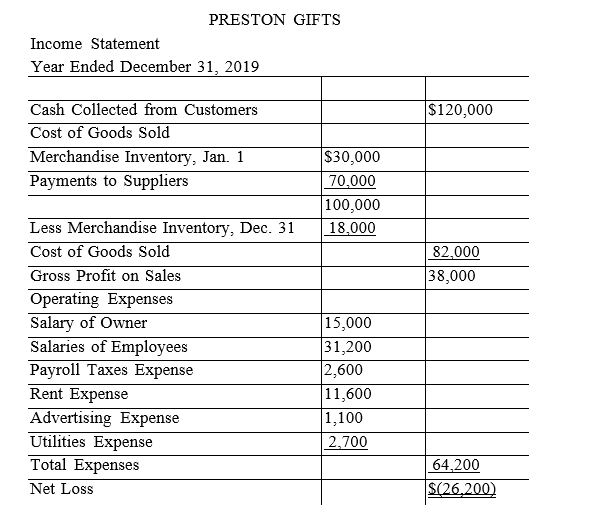

The income statement shown below was prepared and sent by Jenna Preston, the owner of Preston Gifts, to several of her creditors. The business is a sole proprietorship that sells miscellaneous gifts. An accountant for one of the creditors looked over the income statement and found that it did not conform to generally accepted accounting principles. Using the following additional information provided by the owner, prepare an income statement in accordance with generally accepted accounting principles.

Additional information provided by owner:

1. All sales were for cash.

2. The beginning and ending merchandise inventories were valued at their estimated selling price. The actual cost of the ending inventory is estimated to be $12,000. The actual cost of the beginning inventory is estimated to be

$20,000.

3. On December 31, 2019, suppliers of merchandise are owed $11,000. On January 1, 2019, they were owed $14,000.

4. The owner paid herself a salary of $1,250 per month and charged this amount to the Salary of Owner account.

5. A check for $800 to cover the December rent on the owner's personal apartment was issued from the firm's bank account. This amount was charged to Rent Expense.

Definitions:

Late-Onset Diabetes

A common term for type 2 diabetes, which is characterized by the body's ineffective use of insulin and typically develops in adulthood.

Genetic-Programming Theories

Theories that explain biological aging as resulting from a genetically determined developmental timetable.

Immunological Theory

A theory proposing that the immune system plays a significant role in the aging process by becoming less efficient over time.

Wear-And-Tear Theory

A concept suggesting that the body ages as a result of accumulated damage and degradation of cells and tissues over time.

Q39: The entry to record the issuance of

Q41: Allowance for Doubtful Accounts is reported in

Q48: A firm uses a periodic inventory system

Q59: In periods of rising prices, the inventory

Q66: Under the Allowance Method of accounting for

Q74: Gross profit on sales is calculated as<br>A)net

Q82: Uncollectible Accounts Expense is a(n)_ account.

Q88: A company reported the following information regarding

Q96: Which of the following inventory costing procedures

Q111: At the beginning of the current year,