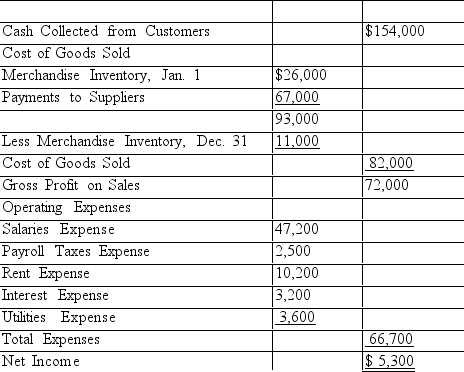

The income statement shown below was prepared and sent by Curtis Brown, the owner of Curt's Crafts, to several of his creditors. The business is a sole proprietorship that sells crafts and toys. An accountant for one of the creditors looked over the income statement and found that it did not conform to generally accepted accounting principles. Using the following additional information provided by the owner, prepare an income statement in accordance with generally accepted accounting principles.

Income Statement

CURT'S CRAFTS

Year Ended December 31, 2019

Additional information provided by owner:

1.On December 31, 2019, accounts receivable from customers total $32,000. On January 1, 2019, accounts receivable totaled $52,000.

2.The beginning and ending merchandise inventories were valued at their estimated selling price. The actual cost of the ending inventory is estimated to be $6,000. The actual cost of the beginning inventory is estimated to be

$18,000.

3.On December 31, 2019 suppliers of merchandise are owed $16,000. On January 1, 2019, they were owed $11,000.

4.The owner paid himself a salary of $1,600 per month and charged this amount to the Salaries Expense account.

5.A check for $300 to cover the December electric bill on the owner's personal home was issued from the firm's bank account. This amount was charged to Utilities Expense.

Definitions:

Positive Economic Profits

Earnings that exceed the total costs, including both explicit and implicit costs, signalling strong market performance.

Monopolistically Competitive

Monopolistically competitive refers to a market structure where many firms sell similar but not identical products, with each firm having some degree of market power.

Short Run

A time period in which at least one factor of production is fixed, focusing on immediate effects.

Long Run

A period of time in economics where all factors of production and costs are variable, allowing full industry adjustment.

Q1: Each type of deduction made from the

Q4: The Medicare tax is levied to provide

Q12: Inventory costing methods are influenced by industry

Q30: Assets are recorded at cost when they

Q30: On June 1, 2019, a firm purchased

Q45: Check marks next to the individual amounts

Q45: Identify the list of accounts below that

Q54: Define the two aspects of the monetary

Q55: On a classified balance sheet, Accounts Payable

Q97: A firm purchased equipment for $6,000 on