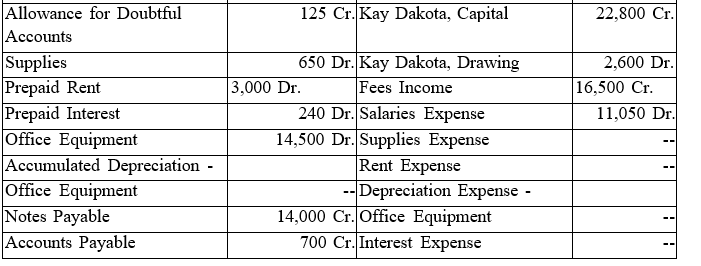

On July 31, 2019, after one month of operation, the general ledger of Dakota Consulting contained the following accounts and balances. The firm adjusts losses from uncollectible accounts only at the end of the fiscal year. Monthly adjustments are listed below. Prepare the Trial Balance, Adjustments, and Adjusted Trial Balance sections of a worksheet.

Adjustments:

(a)On July 31, an inventory of the supplies showed that items costing $250 were on hand.

(b)On July 1, the firm paid $3,000 in advance for 6 months rent.

(c)On July 1, the firm paid $240 interest in advance on a 3-month note that it issued to the bank.

(d)On July 2, the firm purchased office equipment for $14,500. The office equipment is expected to have a useful life of 5 years and a salvage value of

$1,000.

(e)On July 1, the firm issued a 3-month, 9 percent note for $4,000.

(f)During July, the firm received $600 from customers in advance of providing services. An Analyze of the firm's records shows that the full amount applies to services provided in July.

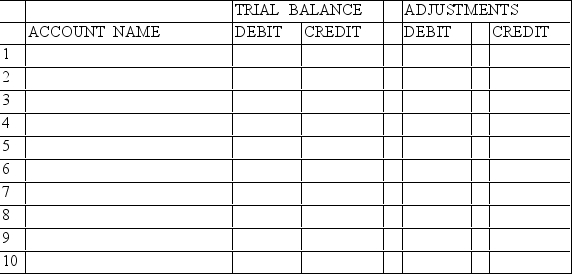

DAKOTA CONSULTING

Worksheet

Month Ended July 31, 2019

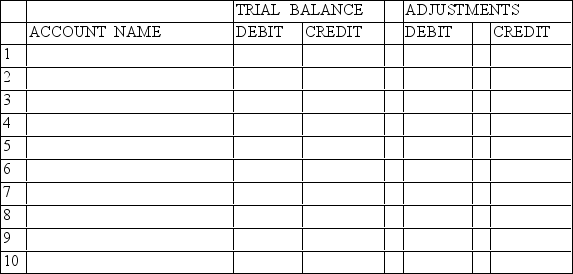

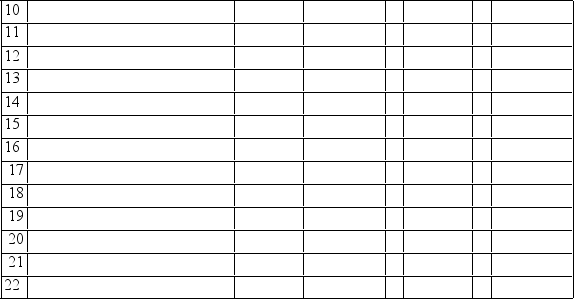

DAKOTA CONSULTING

Worksheet, continued (through Adjusted Trial Balance Column)Month Ended July 31, 2019

Definitions:

Fund Returns

The profit or loss on an investment over a specific period, often expressed as a percentage of the investment's initial value.

Asset Allocation

Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolio's assets according to an individual's goals, risk tolerance, and investment horizon.

Information Ratio

A ratio used to measure the return of a portfolio or fund relative to its risk, often used to assess the skill of a portfolio manager.

Risk-Free Return

The theoretical return attributed to an investment with zero risk, typically associated with government bonds.

Q7: Compute the maturity value of a 5-month,

Q9: Allyse Petry is the owner of a

Q16: Which of the following is not an

Q31: To indicate that an amount has been

Q41: For convenience, accountants assume that the value

Q43: When the allowance method of recognizing losses

Q55: A firm must issue a Form _

Q79: The New York Mets entered into a

Q91: If the uncollectible accounts expense is estimated

Q92: The adjusted trial balance data given below