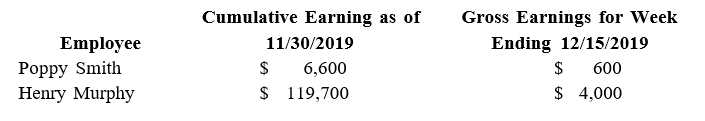

ABC Consulting had two employees with the following earnings information:

-

Use the table above to calculate the employer payroll income taxes associated with Poppy's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $122,700 of annual wages and the Medicare tax rate is 1.45% on all earnings. State unemployment tax of 5.4% and federal unemployment tax of 0.6% are both levied on only the first

$7,000 of each employee's annual earnings.

Definitions:

Situation Analysis

The process of evaluating the current status of a company, organization, or product to understand its context within the market or environment.

Strategic Plan

An organized method for imagining an ideal future and converting this concept into general goals or aims, along with a series of actions to accomplish these goals.

Motivational Objectives

Goals designed to inspire action or change in behavior, often used in marketing, education, and management.

AAPD

The American Association of People with Disabilities, an organization advocating for the civil rights of people with disabilities.

Q4: Define and give an example of all

Q6: How are the concepts of materiality and

Q7: At the end of the current year,

Q32: An employee whose regular hourly rate is

Q34: For the current fiscal year, Purchases were

Q38: The payroll register of the Fox Manufacturing

Q40: Employees submit Form W-4 to their employers

Q44: On a bank reconciliation statement, you would

Q50: The amount to be reported on the

Q85: Which of the following statements is NOT