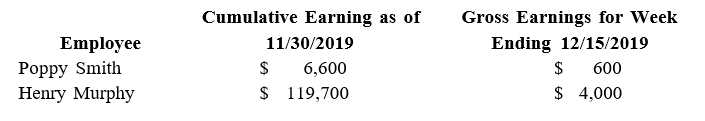

ABC Consulting had two employees with the following earnings information:

-

Use the table above to calculate the employer payroll income taxes associated with Henry's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $122,700 of annual wages and the Medicare tax rate is 1.45% on all earnings. State unemployment tax of 5.4% and federal unemployment tax of 0.6% are both levied on only the first

$7,000 of each employee's annual earnings.

Definitions:

Socio-cultural Fabric

The complex web of social norms, beliefs, traditions, and practices that form the foundation of a society's cultural identity.

Universal Evolutionary Theory

The assertion that all societies must progress in the same manner.

Societies Progress

The advancement and development of societies through improvements in education, technology, social welfare, and governance, aiming for enhanced quality of life.

Urban Legends

Folklore stories often believed to be true but are usually exaggerated or fabricated, typically circulated as cautionary tales or explanations of mysterious phenomena.

Q10: The procedure that most nearly attains the

Q14: The entry to record the issuance of

Q15: Generally, the maximum earnings subject to state

Q21: Use the following account balances from the

Q29: Because of the modifying constraint of _,

Q37: Net income is recorded on the net

Q53: The Sales Returns and Allowances account is

Q56: Which of the following would not be

Q65: <br>A check written by Bosley Co. for

Q88: The balance of the Merchandise Inventory account