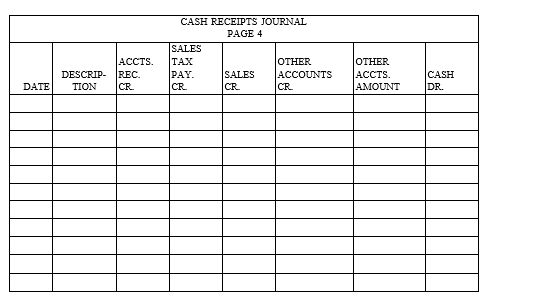

Record the following transactions for the month of April, 2019 on page 4 of a cash receipts journal. Total, prove, and rule the cash receipts journal as of April 30.

April 3 Collected $350 from Margo Daub, a credit customer on account.

1 Kevin Sharp, the owner, invested an additional $5,000 cash in the business.

2 Received a cash refund of $30 for damaged supplies.

15 Had cash sales of $5,500 plus sales tax of $385. There was a cash overage of $5.

18 Received $800 from Brian Cobb, a credit customer, in payment of his account.

20 Received a check from Phil Stout to pay his $700 promissory note plus interest of $42.

30 Had cash sales of $3,800 plus sales tax of $266. There was a cash shortage of $5.

Definitions:

Units Transferred

The quantity of items moved from one stage of production or location to another within a given period.

Step-Down Method

A cost allocation method used in accounting and finance to distribute indirect costs to different departments or products.

Service Department Costs

Expenses incurred by the units that support the production or operations of a company, such as human resources or maintenance.

Personnel Costs

Expenses related to employee compensation, including salaries, benefits, and taxes.

Q10: A post-closing trial balance could include all

Q12: Which of the following accounts is not

Q47: After the Marion Corporation paid its employees

Q50: The process used by FASB in developing

Q59: The employer records the amount of federal

Q74: Samantha Rodriguez had gross earnings for the

Q86: The account accumulated depreciation has a normal_

Q88: The adjusted ledger accounts of Miraldi Landscaping

Q89: Cost of Goods Sold is classified as

Q91: "Income and Expense Summary" is another name