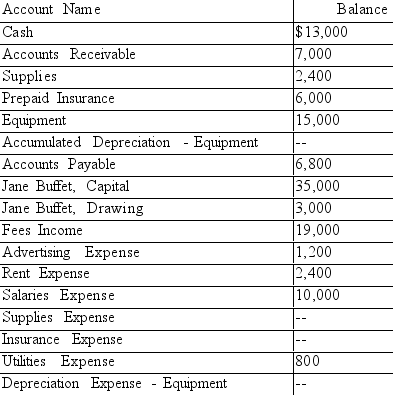

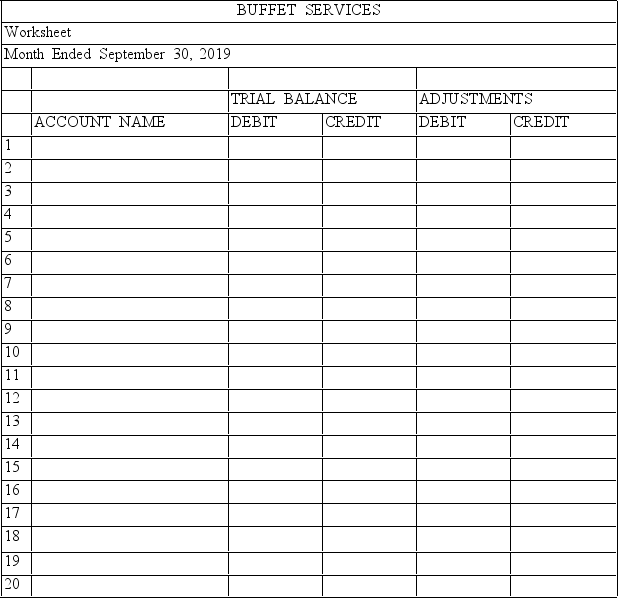

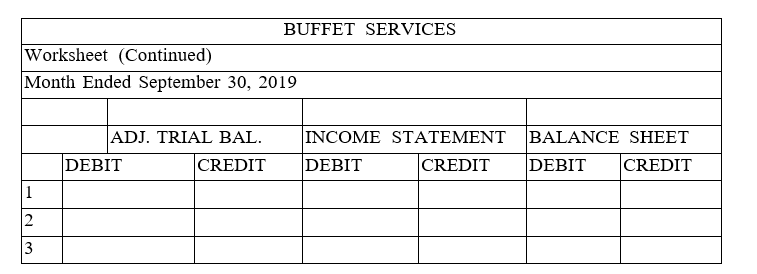

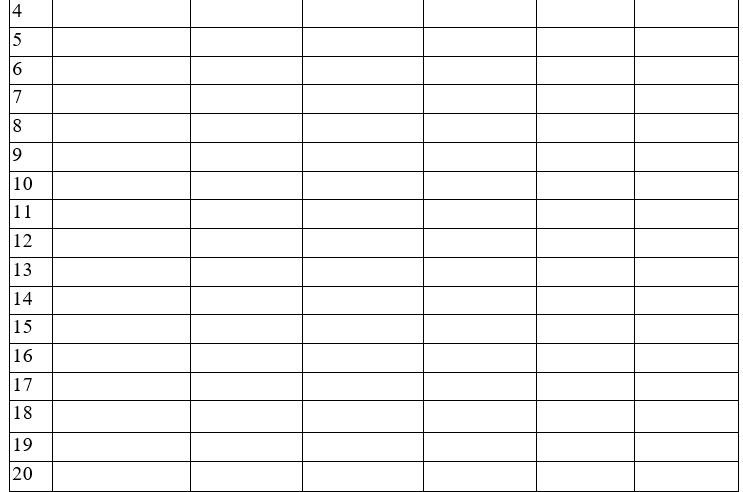

The balances of the ledger accounts for Buffet Services on September 30, 2019, and the information needed for adjustments are shown below. Prepare the Trial Balance section, record the adjustments, and complete the worksheet.

Adjustment information:

(a)The supplies were purchased on September 1, 2019. An inventory of supplies showed $1,200 on hand on September 30, 2019.

(b)The amount of Prepaid Insurance represents a payment made September 1, 2019, for a six-month

insurance policy.

(c)The equipment, purchased September 1, 2019, has an estimated useful life of 5 years with no salvage value. The firm uses the straight-line method of depreciation.

Definitions:

Employment-Related Expenses

Costs incurred by employees during the course of their job that are necessary and not reimbursed by the employer, possibly deductible under certain conditions.

Joint Taxpayer

Two individuals, usually married, who file a single tax return together, combining their incomes and sharing deductions.

Education Credit Deduction

A type of deduction that allows eligible taxpayers to subtract education expenses from their taxable income, enhancing affordability for higher education.

Dependent

An individual, usually a child or spouse, who relies on another person (typically a family member) for financial support and qualifies for certain tax benefits on that person’s tax return.

Q14: A firm can only provide reasonable assurance

Q26: A person who is hired by a

Q26: One of the supplier accounts from the

Q35: An employee's gross earnings minus the necessary

Q47: Which of the following is not a

Q58: The balance of the owner's drawing account

Q63: Use the following account balances from the

Q72: On the income statement, revenues minus expenses

Q77: Managerial Accounting is any activity associated with

Q94: Dorsey Company's partial worksheet for the month