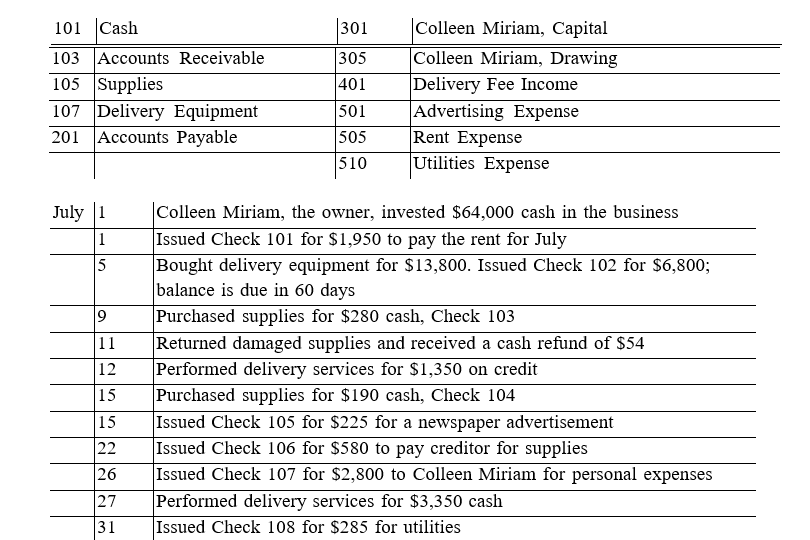

Global Delivery opened for business on July 1, 2019. The company uses the general ledger accounts listed below. During the first month of business, the firm had the transactions listed below. Record the transactions on page 1 of a general journal. Omit descriptions. Set up a Cash general ledger account and post the appropriate transactions to this account, account 101.

Definitions:

Sole Proprietorship

A business structure in which one individual owns all of the company's assets, is responsible for its debts, and reports its business income on their personal tax return.

Non-Profit

An organization dedicated to furthering a particular social cause or advocating for a shared point of interest and does not distribute its surplus funds to owners or shareholders.

Personal Use

The use of a property or item by the owner or their family for non-business and non-rental purposes, affecting the tax implications of expenses related to the property or item.

Schedule E

Schedule E is a form used by taxpayers to report income and losses from rental property, royalties, partnerships, S corporations, estates, and trusts on their tax returns.

Q6: Anna Conda Landscaping service received a bill

Q15: Funds taken from the business by the

Q15: Explain in details the three approaches to

Q29: A partnership has _ owners.

Q37: Withdrawals by the owner for personal use

Q41: Which of the following statements regarding reports

Q56: The financial interest of the owner in

Q92: An account with a balance that carries

Q93: The statement of financial position is another

Q94: When the trial balance totals are not