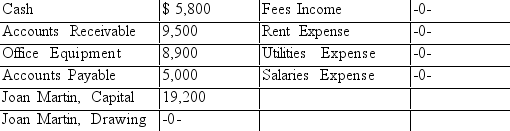

The consulting firm of Martin and Associates uses the accounts listed below. On a separate sheet of paper, set up T accounts for each of the accounts listed and record the balances as of December 1, 2019 on the normal balance side of the accounts.

The firm has the following transactions during the month of December 2019. Record the effects of these transactions in the T accounts.

a. Paid $2,100 for one month's rent

b. Collected $4,500 in cash from credit customers

c. Performed services for $8,300 in cash

d. Paid $5,300 for salaries

e. Issued a check for $2,750 to a creditor

f. Performed services for $11,650 on credit

g. Purchased office equipment for $3,200 on credit

h. The owner withdrew $2,800 in cash for personal expenses

i. Issued a check for $925 to pay the monthly utility bill

Determine the account balances after the transactions have been recorded Prepare a trial balance as of December 31, 2019.

Definitions:

Endorser

An individual or entity that signs a document (usually on its reverse side) indicating support, approval, or transfer of rights.

Full Amount

The total, complete sum of money owed or required in a transaction.

Accommodation Party

A person who signs a negotiable instrument on behalf of another, guaranteeing payment without receiving any personal benefit.

Primary Liability

The main or direct obligation to repay a debt or fulfill a contractual duty, without relying on secondary sources for payment.

Q37: What are the risks associated with employee

Q37: A successful implementation of an ERP system

Q38: When an entry is made in the

Q39: In terms of the general ledger and

Q65: Antonio Baldez operates a delivery service. During

Q65: If the prepaid expenses are not adjusted,

Q76: If the income statement covered a six-month

Q89: The process of recording transactions in a

Q90: When cash is collected from accounts receivable,

Q97: The sales journal for Carothers Company is