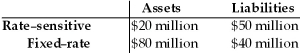

Table 23.1

First National Bank

-Refer to Table 23.1.Assuming that the average duration of its assets is five years,while the average duration of its liabilities is three years,a rise in interest rates from 5% to 10% will cause the net worth of First National to ________ by ________ of the total original asset value.

Definitions:

Equally-Weighted

An investment strategy where each asset in a portfolio is given the same weight or importance.

Returns

The money made or lost on an investment, usually expressed as a percentage of the investment's initial cost.

Period

A specific span of time during which certain financial or economic activities are measured or observed.

Time Weighted

Time-weighted is an investment return calculation method that eliminates the effects of cash flows in and out of the portfolio, focusing on the investment manager's performance over time.

Q33: If the liquidity effect is smaller than

Q37: Why are financial intermediaries so important to

Q38: Banks' attempts to solve adverse selection and

Q57: A deferred load is a fee charged

Q68: The Glass-Steagall Act made it illegal for

Q69: Insurance companies' attempts to minimize adverse selection

Q70: The fact that insurance companies charge young

Q78: Most investment banks are attached to<br>A)large commercial

Q86: Savings and loans are not as heavily

Q101: When the demand for bonds _ or