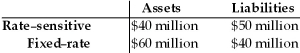

Table 23.2

First National Bank

-Refer to Table 23.2.Assuming that the average duration of the bank's assets is four years,while the average duration of its liabilities is three years,a rise in interest rates from 5 percent to 10 percent will cause the net worth of First National to ________ by ________ of the total original asset value.

Definitions:

Null Hypothesis

A hypothesis in statistical tests that assumes no effect or no difference between groups or conditions being compared.

Consecutive Weeks

A succession of weeks that occur consecutively without any breaks.

Confidence Interval

A variety of values, based on statistics from a sample, which is conjectured to envelop an obscure population parameter.

P-value

A statistical concept indicating the probability of observing data as extreme as those seen, if the null hypothesis were true, used in hypothesis testing.

Q13: With an interest rate of 8 percent,

Q18: Discuss the regulatory environment for finance companies

Q18: How does reinvestment risk differ from interest-rate

Q21: State banks that are not members of

Q23: What is meant by the risk structure

Q27: The largest full-service broker is _.<br>A)Bank of

Q33: By selling short a futures contract of

Q47: Discuss what is shown by a yield

Q56: The primary function of investment banks is<br>A)the

Q67: In the 1980s, thrift institutions, which had