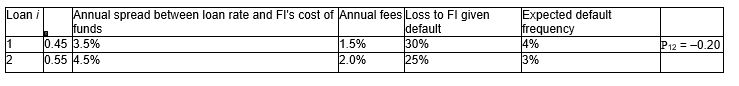

Consider an FI that holds two loans with the following characteristics:  What is the risk of the loan portfolio (round to two decimals) ?

What is the risk of the loan portfolio (round to two decimals) ?

Definitions:

Long-Run Equilibrium

A situation in competitive markets where all firms are making normal profits, and there is no incentive for market entry or exit.

Marginal Cost

An increase in the full cost that comes from producing an additional unit of a product or service.

Monopolistic Competition

A market structure characterized by many firms selling products that are substitutes but not perfect substitutes, leading to each firm having some market power.

Perfect Competition

A market structure characterized by an infinite number of small firms, identical products, and easy market entry and exit, leading to companies not having pricing power.

Q2: The most important banking area in which

Q9: Which of the following is a reason

Q14: Which of the following statements is true?<br>A)In

Q30: Economies of scope imply an FI's ability

Q32: Private placement refers to a securities issue

Q40: Immunisation of a portfolio implies that changes

Q42: The repricing model ignores information regarding the

Q46: Diseconomies of scope refers to the:<br>A)fall in

Q47: A positive net exposure position in FX

Q48: Duration measures changes in an FI's net