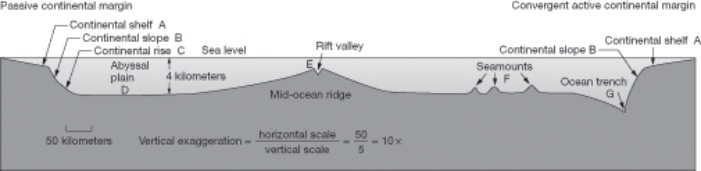

Refer to the figure below.Match the term to the numbered ocean floor feature on the figure.You may use each answer once,more than once,or not at all.

-abyssal plain

Definitions:

MM Model

MM Model refers to the Modigliani-Miller theorem, which propositions about the irrelevance of capital structure in determining the overall value of a firm under certain market conditions and assumptions.

Optimal Capital Structure

Optimal capital structure is the ideal mix of debt and equity financing that minimizes a company's cost of capital and maximizes its stock price.

Cost Of Capital

Represents the rate of return that a company must earn on its investment projects to maintain its market value and attract funds.

Financial Leverage

The use of borrowed money (debt) to amplify the potential returns from an investment or project.