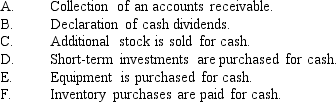

Assuming a starting point of a 1:1 relationship, state the effect of the following transactions on the current ratio. Use increase, decrease, or no effect for your answer.

Definitions:

Market Risk

The risk of losses in investments caused by factors that affect the entire market, such as economic changes or political events.

Beta

An assessment tool for determining the comparative volatility or systematic risk of a portfolio or security against the market at large.

Volatility

Volatility is a statistical measure of the dispersion of returns for a given security or market index, indicating the degree of variation from the average over a certain period.

CAPM

The Capital Asset Pricing Model is a formula used to determine the expected return on an investment, factoring in its risk compared to the market.

Q1: Which method of preparing the operating activities

Q10: Which of the following best describes the

Q32: A high accounts receivable turnover ratio indicates<br>A)

Q33: A company has an average inventory on

Q33: In economics,which of the following represents entrepreneurship?<br>A)

Q36: A ratio that indicates what proportion of

Q93: Markup<br>A)the difference in total cost between the

Q109: Sold equipment used in the business for

Q140: The two types of capital budgeting projects

Q140: Refer to Figure 3.1.Consider the market for