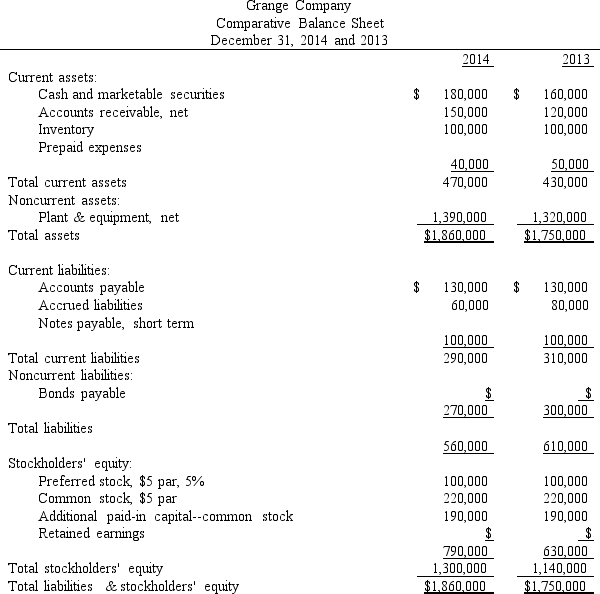

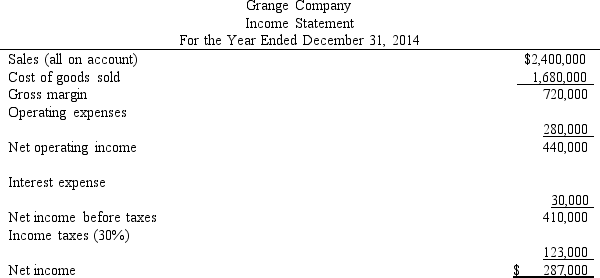

Figure 16-2.Financial statements for Grange Company appear below:

Dividends during 2014 totaled $127,000, of which $5,000 were preferred dividends.The market price of a share of common stock on December 31, 2014, was $100.

Dividends during 2014 totaled $127,000, of which $5,000 were preferred dividends.The market price of a share of common stock on December 31, 2014, was $100.

-Smith Inc. is a wholesaler of snow skiing gear. During 2014, Smith expanded its retail business by adding over 50 shops. The following information is obtained from the comparative financial statements included in the company's 2014 annual report.

Definitions:

TRICARE

TRICARE is a health care program of the United States Department of Defense Military Health System providing health benefits to military personnel, retirees, and their dependents.

Health Insurance Plan

An insurance that covers the whole or a part of the risk of a person incurring medical expenses, spreading the risk over a large number of persons.

TRICARE for Life

A healthcare program for U.S. military retirees and their dependents, providing Medicare-wraparound coverage.

Medicare

Medicare is a federal health insurance program in the United States for people aged 65 and older, as well as for some younger people with disabilities.

Q45: How long it takes a company to

Q49: Horizontal analysis is a technique for evaluating

Q67: The largest component of U.S.GDP is:<br>A) Government

Q79: _ represents the percentage of each sales

Q120: An example of horizontal analysis is the

Q130: What do profitability ratios measure and what

Q155: Which model of capital investment decision making

Q157: The _ is calculated by dividing the

Q161: Depreciation of equipment is an example of

Q162: Refer to Figure 14-3. What is the