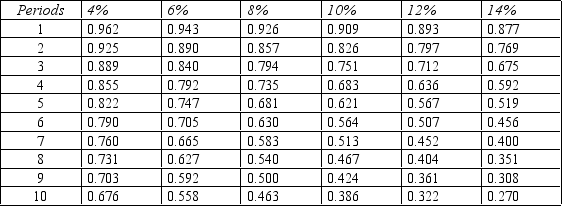

Figure 14-10.Present value of $1

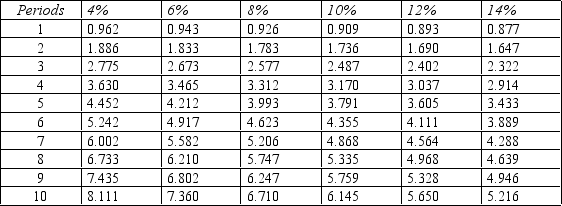

Present value of an Annuity of $1

Present value of an Annuity of $1

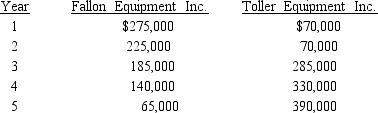

-Refer to Figure 14-10. Ray Corporation is looking to invest in a new piece of equipment. Two manufacturers of this type of equipment are being considered. After-tax inflows for the two competing projects are:

Both projects require an initial investment of $400,000. In both cases, assume that the equipment has a life of 5 years with no salvage value.

Both projects require an initial investment of $400,000. In both cases, assume that the equipment has a life of 5 years with no salvage value.

Required:

A. Assuming a discount rate of 8%, compute the net present value of each piece of equipment.

B. A third option is now available for a supplier outside of the country. The cost is also $400,000, but it will produce even cash flows over its 5-year life. What must the annual cash flow be for this equipment to be selected over the other two? Assume an 8% discount rate.

Definitions:

Temporary Leave

Temporary leave is a period of time when an employee is officially allowed to be absent from their workplace for various reasons, such as health issues or personal matters.

Temporary Liaison

A short-term collaboration or relationship established to achieve a specific goal.

Experienced Manager

A professional who has gained a significant amount of expertise and knowledge in managing through years of practice and learning.

Less Experienced

Describes individuals or entities that have limited exposure, knowledge, or skills in a particular area or activity due to fewer opportunities to practice or engage in it.

Q1: The net income reduced by the total

Q34: Limited resources and limited demand for a

Q35: Refer to Figure 13-6. Should Autry process

Q41: For meaningful analysis, ratios should be compared

Q90: Responsibility for the variable overhead spending variance

Q99: Refer to Figure 16-2.<br>Required: Compute the following

Q125: Which of the following is not an

Q131: The Balanced Scorecard perspective that defines the

Q159: A cost that cannot be affected by

Q160: The value of an investment at the