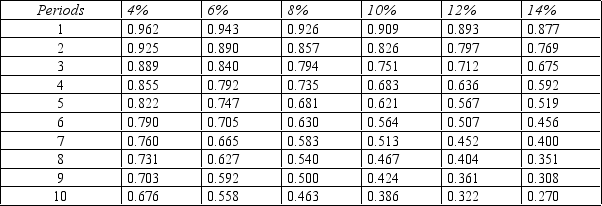

Figure 14-6.Present value of $1

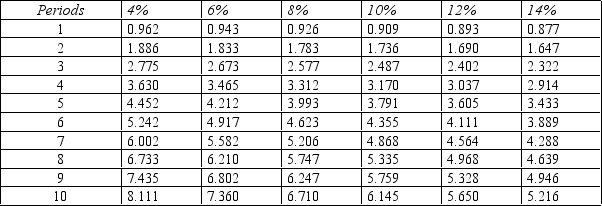

Present value of an Annuity of $1

Present value of an Annuity of $1

-Refer to Figure 14-6. Roman Knoze is considering two investments. Each will cost $20,000 initially. Project 1 will return annual cash flows of $10,000 in each of three years. Project 2 will return $5,000 in year 1, $10,000 in year 2, and $15,000 in year 3. Roman requires a minimum rate of return of 10%. What is the net present value of Project 1? (Note: there may be a rounding error depending on the table you use to compute your answer. Choose the answer closest to the one you calculate.)

Definitions:

Economic Decisions

Choices made by individuals, businesses, and governments regarding resource allocation, production, and consumption, influenced by economic conditions and objectives.

Payroll Tax

Financial demands on employers and employees, typically derived as a percentage of the remunerations paid to staff.

Labor Supply

The total hours that workers are willing to work at a given wage rate, influenced by various factors like salaries, working conditions, and demographics.

Excess Burden

Excess burden is the economic loss society incurs as a result of tax inefficiencies, beyond the tax itself, often due to distorted economic behaviors.

Q56: Phillips Company had $300,000 in sales on

Q66: A formula for the accounting rate of

Q86: Dolan Company's income statement showed revenues of

Q100: The two major categories of capital investment

Q101: Refer to Figure 13-3. Assume that EBP

Q109: MCE (manufacturing cycle efficiency) is calculated using

Q118: Measures the ability of a company to

Q126: Purchase of a building for cash.<br>A)Added to

Q140: Last night, Shirley worked on her accounting

Q165: Refer to Figure 13-4. What is the