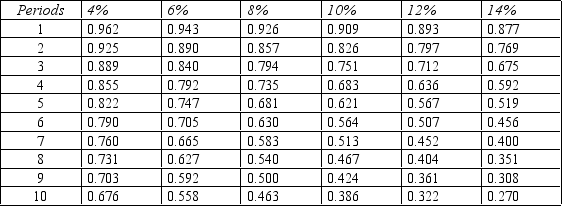

Figure 14-10.Present value of $1

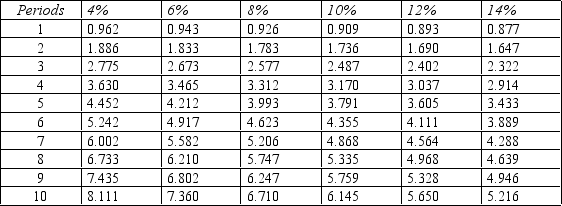

Present value of an Annuity of $1

Present value of an Annuity of $1

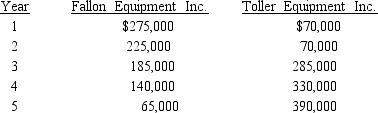

-Refer to Figure 14-10. Ray Corporation is looking to invest in a new piece of equipment. Two manufacturers of this type of equipment are being considered. After-tax inflows for the two competing projects are:

Both projects require an initial investment of $400,000. In both cases, assume that the equipment has a life of 5 years with no salvage value.

Both projects require an initial investment of $400,000. In both cases, assume that the equipment has a life of 5 years with no salvage value.

Required:

A. Assuming a discount rate of 8%, compute the net present value of each piece of equipment.

B. A third option is now available for a supplier outside of the country. The cost is also $400,000, but it will produce even cash flows over its 5-year life. What must the annual cash flow be for this equipment to be selected over the other two? Assume an 8% discount rate.

Definitions:

Right-Brained

A popularized concept suggesting that the right hemisphere of the brain is more involved in creative and intuitive processes.

Dendrites

The branched projections of a neuron that act to conduct the electrochemical stimulation received from other neural cells to the cell body, or soma.

Skill

A learned ability to carry out a task with pre-determined results often within a given amount of time, energy, or both.

Anatomy

The branch of science concerned with the bodily structure of humans, animals, and other living organisms, especially as revealed by dissection and the separation of parts.

Q21: A _ is a budget created in

Q32: Cash flows from acquiring and retiring long-term

Q38: When a product is transferred at market

Q51: Refer to Figure 11-7. Assume that Kipling

Q105: Refer to Figure 14-3. What is the

Q107: The Engine Division provides engines for the

Q126: Purchase of a building for cash.<br>A)Added to

Q133: Foster Industries manufactures 20,000 components per year.

Q152: Collection of Sales Revenue<br>A)Operating Activity, Source of

Q163: When the selling division can sell and