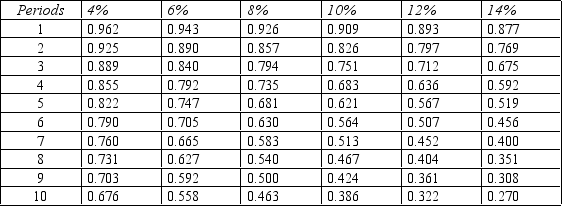

Figure 14-10.Present value of $1

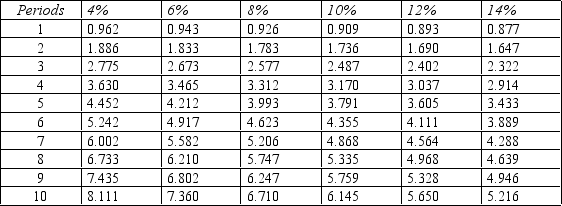

Present value of an Annuity of $1

Present value of an Annuity of $1

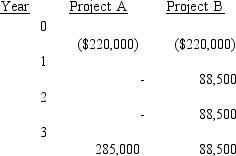

-Refer to Figure 14-10. Durrel Company is considering two different modifications to its current manufacturing process. The after-tax cash flows associated with the two investments are as follows:

Durrel's cost of capital is 6%.

Durrel's cost of capital is 6%.

Required:

A. Compute the NPV for each investment and state which project should be chosen based on the NPV.

B. Compute the IRR for each investment and state which project should be chosen based on the IRR.

Definitions:

George Ritzer

A sociologist best known for his concept of McDonaldization, which criticizes the rationalized processes of efficiency, predictability, calculability, and control in societal institutions.

"Nonplaces"

Spaces characterized by transitory and impersonal relations, such as airports and supermarkets, as defined by anthropologist Marc Augé.

Subtype

A specialized form or variation of a broader category or group.

McDonaldization

The process by which the principles of the fast-food restaurant are coming to dominate more sectors of American society as well as the rest of the world, leading to increased efficiency, predictability, calculability, and control through the substitution of non-human for human technology.

Q51: Companies that perform postaudits of capital projects

Q59: Cooper Industries is considering a project that

Q62: Curtis Company sets price equal to cost

Q110: A _ compares actual costs with budgeted

Q118: In an activity flexible budget, the variable

Q124: A _ can be used to structure

Q158: Constraints<br>A)the difference in total cost between the

Q158: An activity-budgetary system has the following benefit(s):<br>A)

Q168: Which of the following is true regarding

Q186: A company measures how efficiently it is