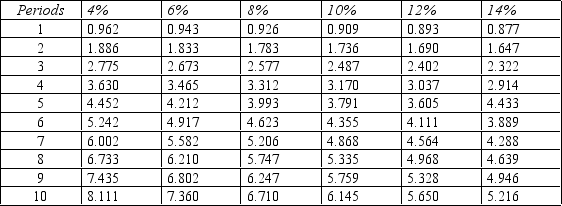

Figure 14-11.Present value of an Annuity of $1 in Arrears

-Refer to Figure 14-11. Aragon Company is considering an investment in equipment that will have an initial cost of $560,290 and yield annual net cash inflows of $90,000. Yearly depreciation will be $56,000. The equipment is expected to be useful for 10 years and then it will be scrapped. Aragon requires a minimum rate of return of 10%.

Definitions:

Test Statistic

A number derived from sample observations in a hypothesis test, essential for determining the rejection of the null hypothesis.

Null Hypothesis

A default hypothesis that there is no significant difference or effect, used as a starting point for statistical testing.

Type I Error

A Type I error occurs when a true null hypothesis is incorrectly rejected.

Q7: Refer to Figure 13-8. Assume that the

Q10: Buster Evans is considering investing $20,000 in

Q11: If the National Division of American Products

Q12: If net present value is negative, it

Q104: Several transfer pricing policies are used in

Q108: Presented below are selected data from

Q110: _ consists of choosing among alternatives with

Q112: A(n) _ is a responsibility center in

Q130: What do profitability ratios measure and what

Q137: Dance Unlimited Company reported net income of