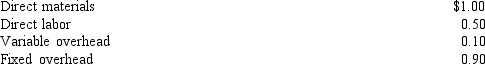

Aerotoy Company makes toy airplanes. One plane is an excellent replica of a 737; it sells for $5. Vacation Airlines wants to purchase 12,000 planes at $1.75 each to give to children flying unaccompanied. Costs per plane are as follows:  No variable marketing costs would be incurred. The company is operating significantly below the maximum productive capacity. No fixed costs are avoidable. However, Vacation Airlines wants its own logo and colors on the planes. The cost of the decals is $0.01 per plane and a special machine costing $1,500 would be required to affix the decals. After the order is complete, the machine would be scrapped. Should the special order be accepted?

No variable marketing costs would be incurred. The company is operating significantly below the maximum productive capacity. No fixed costs are avoidable. However, Vacation Airlines wants its own logo and colors on the planes. The cost of the decals is $0.01 per plane and a special machine costing $1,500 would be required to affix the decals. After the order is complete, the machine would be scrapped. Should the special order be accepted?

Definitions:

Tax Reform Act

Legislation aimed at altering the tax system, typically involving changes in tax rates, tax policies, and tax revenue allocations.

Kemp-Roth Tax Cut

A significant federal tax reduction in the United States passed in 1981 aimed at stimulating economic growth through lower individual income tax rates.

Corporate Income Tax

Taxes levied on the profits earned by corporations, which vary by country and influence companies' financial strategies.

Excise Taxes

Taxes levied on the sale of specific goods and services, such as gasoline, cigarettes, and alcohol.

Q9: Suppose that the actual cost of capital

Q14: Variable overhead efficiency variance<br>A)(Actual hours - Standard

Q53: Refer to Figure 16-4.<br>Required: Calculate the following

Q55: Assuming a statement of cash flows is

Q68: An unfavorable variable overhead spending variance may

Q85: _ ignore the time value of money.

Q111: Performance report<br>A)(Actual hours - Standard hours)SVOR<br>B)Prediction of

Q120: Tessa Wilson invested in a project with

Q128: Classy Carry manufactures two types of handbags,

Q135: A tool used to provide the production