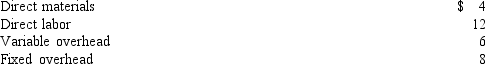

Gundy Company manufactures a product with the following costs per unit at the expected production of 30,000 units:  The company has the capacity to produce 30,000 units. The product regularly sells for $40. A wholesaler has offered to pay $32 per unit for 2,000 units.

The company has the capacity to produce 30,000 units. The product regularly sells for $40. A wholesaler has offered to pay $32 per unit for 2,000 units.

If the firm chooses to accept the special order and reject some regular sales, the effect on operating income would be

Definitions:

Incremental

Pertaining to a small or marginal change, often in cost or quantity, that results from a variation in operations or production level.

After-Tax Cash Flows

The amount of money a business or individual has left after all taxes have been paid, indicating the net income available for spending or reinvestment.

Capital Budgeting

The process of evaluating and selecting long-term investments that are aligned with the firm's strategic goals.

Net Working Capital

The difference between a company's current assets and its current liabilities.

Q13: Last year Frye Company's cash account increased

Q28: The activity from the balance sheet to

Q59: Refer to Figure 12-4. Assume that Style

Q64: Refer to Figure 13-2. Now suppose that

Q77: The net income reported on the income

Q102: The quantity of each input that should

Q126: Purchase of a building for cash.<br>A)Added to

Q150: The following information is available for the

Q154: Refer to Figure 12-3. Assume that Grey

Q157: Crawford Company's standard fixed overhead cost is