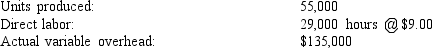

Markus, Inc. produces a specialized machine part used in forklifts. For last year's operations, the following data were gathered:  Markus employs a standard costing system. During the year, a variable overhead rate of $5.00 was used. The labor standard requires 0.50 hours per unit produced. The variable overhead spending and efficiency variances are, respectively

Markus employs a standard costing system. During the year, a variable overhead rate of $5.00 was used. The labor standard requires 0.50 hours per unit produced. The variable overhead spending and efficiency variances are, respectively

Definitions:

Preincorporation Contract

An agreement entered into on behalf of a corporation before it is legally formed.

Corporate Promoter

An individual or entity that undertakes the efforts to organize and establish a corporation, including arranging initial capital, legal requirements, and business plans.

Liable

Subject to legal responsibility or obligation, typically involving financial restitution.

Fiduciary Duty

A legal obligation of one party to act in the best interest of another party, such as a trustee's duty towards a beneficiary.

Q25: _ is the difference between the actual

Q29: Economic value added (EVA) is similar to

Q33: Refer to Figure 9-1. Desired ending inventory

Q73: Activity flexible budget<br>A)(Actual hours - Standard hours)SVOR<br>B)Prediction

Q78: A production budget is most important for

Q99: Leeds Company uses the following rule to

Q104: Looking backward to determine what actually happened

Q123: On a segmented income statement, fixed expenses

Q132: _ is calculated by multiplying the unit

Q159: Refer to Figure 9-3. What is the