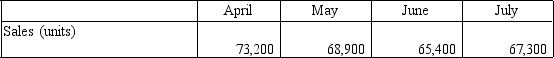

Boyle Company has put together the following data in order to complete their operating budget for the second quarter in 20XX: Additional information:

Additional information:

Company policy requires 60% of next month's sales (in units) be in ending inventory. This policy was met in March.

It takes 2.5 hours of direct labor to produce one unit.

The average wage cost is $14.

Variable overhead rate is $6 per direct labor hour and fixed overhead is $15,000 per month.

Required:

A. Prepare a production budget for April, May, June and the quarter in total.

B. Prepare a direct labor budget for April, May, June and the quarter in total.

C. Prepare an overhead budget for April, May, June and the quarter in total.

Definitions:

Dividends Received Deduction

A tax deduction that a corporation can claim for dividends received from other corporations within the same tax group.

Taxable Income

The portion of an individual's or entity's income used to determine how much tax is owed to the government in a given tax year.

Domestic Corporation

A corporation that is registered, operates, and is taxed in its home country, adhering to the legal and regulatory standards of that country.

Fiscal Year-End

The completion of a one-year, or twelve-month, accounting period, after which financial statements are produced.

Q2: Refer to Figure 6-3. Kelley's total costs

Q7: A production report is divided into two

Q53: Eider Company has the following information:<br> <img

Q62: The _ tells how many units must

Q65: Which of the following is not true

Q70: Refer to Figure 8-4. What is the

Q97: Total Direct Labor Variance<br>A)Actual Quantity * Actual

Q115: Refer to Figure 10-6. Calculate the Extreme

Q137: Any product or service that is basically

Q150: Environmental costs which the firm is not