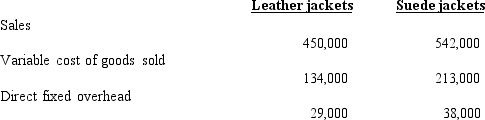

Prepare a segmented income statement for Mario Co. for the coming year, using variable costing. A sales commission of 2% of sales is paid for each of the two product lines. Direct fixed selling and administrative expense was estimated to be $32,000 for the leather jackets and $66,000 for the suede jackets. Common fixed overhead for the factory was estimated to be $83,000 and common selling and administrative expense was estimated to be $14,000.

A sales commission of 2% of sales is paid for each of the two product lines. Direct fixed selling and administrative expense was estimated to be $32,000 for the leather jackets and $66,000 for the suede jackets. Common fixed overhead for the factory was estimated to be $83,000 and common selling and administrative expense was estimated to be $14,000.

Required: Prepare a segmented income statement for Mario Co. for the coming year, using variable costing.

Definitions:

Budgeted Costs

Estimated expenses planned for a specific period, used for financial planning and monitoring.

Investment Center Managers

Managers responsible for a business unit that directly impacts both revenue and costs, and therefore, the unit's profitability.

Investment Center Assets

Resources and assets managed within a business segment or division that is responsible for its own revenues, expenses, and investments, allowing for performance measurement.

Service Department Expenses

Costs incurred by the departments that support the production or operation departments but do not directly contribute to the production of goods.

Q19: Which of the following is not an

Q42: Refer to Figure 9-10. How many boxes

Q42: When using _ a company only assigns

Q68: Using normal costing, which of the following

Q86: Russell Company uses Beltran Company and Southern

Q92: Rudd Company uses 40,000 micro-chips each year

Q94: Refer to Figure 9-4. What is the

Q116: The direct materials purchases budget is based

Q123: Refer to Figure 10-8. What is the

Q138: Discuss the following statement: "Since fixed overhead