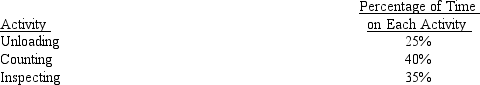

Figure 7-1.The receiving department of Owen has three activities: unloading, counting goods, and inspecting. Unloading requires a forklift that is leased for $15,000 per year. The forklift is used only for unloading. The fuel for the forklift is $2,000 per year. Inspection requires special testing equipment that has a depreciation of $500 per year and an operating cost of $1,000 per year. Receiving has four employees who each have an average salary of $35,000 per year. The work distribution matrix for the receiving personnel is as follows:

-Refer to Figure 7-1. Calculate the cost for inspection.

Definitions:

Processing Costs

Expenses related to the operations required to transform raw materials into finished products.

Split-off Point

In process costing, the stage in the manufacturing process where joint products can be physically separated and identified as individual products.

Joint Process

A production process in which multiple products are produced simultaneously from the same raw materials or input.

Chevy Impala

A model of car manufactured by Chevrolet, known for its full-size sedan form and iconic status in automotive history.

Q24: Refer to Figure 9-1. Raw materials purchases

Q31: Refer to Figure 8-10. What is the

Q34: units pass through one process before they

Q48: When products consume overhead activities in systematically

Q110: Allison Company adopted a standard cost system

Q125: _ is concerned with doing the activity

Q143: A single overhead rate calculated using all

Q150: In going from the sales budget to

Q164: Inspection time for a plant is 10,000

Q176: Refer to Figure 10-2. The variance that